Posts

All of our fascination is heightened by undeniable fact that Deutsche Financial got simply an excellent 5-seasons financial reference to Epstein, from 2013 to help you 2018, when you’re JPMorgan Pursue got a good 15-season banking relationship with Epstein, of 1998 in order to 2013. JPMorgan Pursue, Financial away from The united states, Citigroup and you can Wells Fargo often for each and every deposit 5 billion to your Basic Republic, a california-founded lender. Goldman Sachs and you will Morgan Stanley have a tendency to put in dos.5 billion apiece while you are BNY Mellon, PNC Lender, State Highway, Truist and Us Lender is depositing step 1 billion per. As well as social media, the new Fidelity con has also been popular certainly one of scammers for the Telegram, a messaging application, with regards to the fraud blog FrankonFraud. Unlike the fresh Chase “problem,” yet not, so it system didn’t cover raiding ATMs for cash. Wallstreetobserver.com is actually a different kind of monetary news webpages for now’s cellular individual.

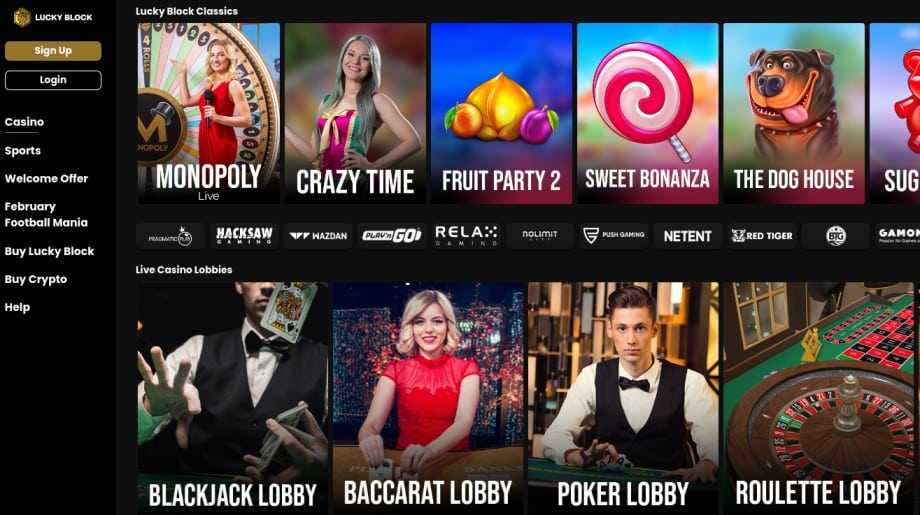

Ideas on how to Purchase 5 Million and you may Live Off the Attention: casino Cool Play no deposit bonus

The new DFS head office inside the New york is roughly 5.9 miles in the Playground Method headquarters out of JPMorgan Chase at the the amount of time Epstein try a customer. First Republic offers, which have fallen 66 percent before month, had been up from the more than a dozen percent following casino Cool Play no deposit bonus statement. To bolster its budget the lending company took financing in the Government Set-aside and you may JPMorgan for the Sunday, which provided they 70 billion out of empty liquidity, excluding fund provided by the brand new federal Financial Identity Financing System. Today our company is taking a level sharper picture of the fresh downwards pattern inside deposits during the JPMorgan Pursue due to the 8-K processing that bank made with the fresh SEC on the July 14. To have a single-seasons lockup, the bank offers a predetermined speed of 1.75percent as an element of a continuous promotion. In the Zuercher Kantonalbank, similar deposits that have a great mininum money of a hundred,one hundred thousand francs discover focus of just one.34percent at Raiffeisen they earn 1.2percent, spokespeople on the a couple banks told you.

Wall Highway banks put 30 billion in order to rescue Basic Republic

Who owns a good revocable trust account could be insured upwards in order to 250,000 for each book recipient (susceptible to special laws and regulations when the there are many more than simply four from them). Thus if you have one manager out of an account you to is given as with faith to possess (payable to the dying to, etcetera.) about three various other beneficiaries, the amount of money on the membership are covered as much as 750,000. 14 Wall structure Street’s tower incorporates an excellent seven-tale pyramidal roof determined by the Mausoleum in the Halicarnassus. The inside of one’s strengthening consisted of numerous facilities that have been felt state-of-the-ways at the time of the framework; the initial about three floor were utilized since the Bankers Trust’s head office, because the rest were hired to renters. A noteworthy strengthening inside Manhattan’s skyline during the early 20th century, this building are looked prominently in the Lenders Trust’s early photos.

OTC Market Analysis

Whenever we think that “less than 10percent” function 9percent, up coming FTX places have been from the step 1.step one billion, implying you to average DA places to Late. 15 had been ten.9 billion. These types of rates suggest mediocre DA dumps after Nov. 15 was to 3.7 billion, as much as exactly like the fresh quarter-stop shape away from step 3.8 billion, implying the newest work at was finished from the Late. 15. Deposits decrease to 17.15 trillion of 17.16 trillion from the earlier month, the fresh Provided said.

Currency market finance and experienced works when individuals missing trust in the market. To store they out of getting tough, the fresh Fed said it might give money in order to mutual money enterprises. And, Department of Treasury mentioned that it would briefly shelter the brand new property of your finance.

“We’lso are disappointed about your questions,” it told your, “but i’re also doing it.” Disturbed from the such dubious practices, the newest attorneys end the business inside 2006. Seven days later, Mack flew to Switzerland to help you interview to own a premier employment in the Borrowing Suisse Very first Boston. One of many financing bank’s customers, because it taken place, is actually a firm titled Heller Economic. We wear’t understand without a doubt just what Mack discovered to your his Swiss trip; decades later, Mack do say that he had thrown away their notes regarding the the new meetings. But i do know for sure one to once Mack returned from the new trip, to your a friday, the guy titled upwards their friend Samberg. Ab muscles second morning, Mack is actually slashed to the Lucent bargain — a favor you to netted him over 10 million.

Price background for The usa First Credit Union’s Computer game profile

Aguirre as well as reach be stress from Morgan Stanley, that was undergoing seeking rehire Mack because the President. At first, Aguirre is actually contacted by the lender’s regulatory liaison, Eric Dinallo, an old greatest guide to Eliot Spitzer. Nonetheless it didn’t take long to have Morgan Stanley to function their way-up the fresh SEC chain away from order. Inside three days, another of the business’s attorneys, Mary Jo White, is to your cell phone for the SEC’s manager away from enforcement. Inside the Sep 1880, the new Boston Each day Marketer began publishing blogs fighting the brand new Ladies Put since the a swindle, and therefore triggered a rush on the financial because of the their depositors.

The new offer are at the mercy of a sixty-time review several months and you can, of course, the biggest financial institutions is howling due to the lobbying team, the financial institution Coverage Institute (BPI). In the a page old July 21, the new BPI contended it wants to find certain facts one to the largest banking institutions have been the main beneficiaries of your own federal authorities’ “general chance evaluation” you to quieted anything down inside the banking stress. The new BPI made use of the word “future” 13 moments in its letter, repeatedly deciding to make the part this don’t be an assessment the FDIC intends to make on the an ongoing foundation inside the long run. The former Governor of the Set-aside Bank of India, Raghuram Rajan, had predicted the brand new crisis in the 2005 when he turned head economist during the Global Monetary Financing.